The price of almost everything has risen and is expected to keep rising thanks to the cost of living crisis currently battering the UK.

But with millions of households struggling to cover the cost of daily essentials and feeling anxious about unexpected expenses cropping up, what should you do when your bank balance drops to a dangerously low level?

In this article, we’ll let you know what steps you should take if your budget is being stretched to its limit and it feels like you have more money going out than coming in.

Why choose Creditfix?

- Write off unsecured debts over £6,000

- Stop interest and charges soaring

- Reduced payments from £110 per month

Identify the problem

If you have a negative budget, it means you are, essentially, spending more than you are bringing in.

It can be easy to jump to conclusions and assume that you have a negative budget due to poor money management or reckless spending. But whilst this is often the case, you can also have a negative budget if you are in a low-paid job and spend the majority of your earnings on essential costs like utilities or rent.

By identifying the problem, you can put a stop to any unnecessary expenses and make your finances stretch to meet your essential costs.

This could be an unused subscription or membership you don’t use, an expired free trial, or just mindless spending with small purchases a slippery slope that can lead to overspending.

Prioritise your spending

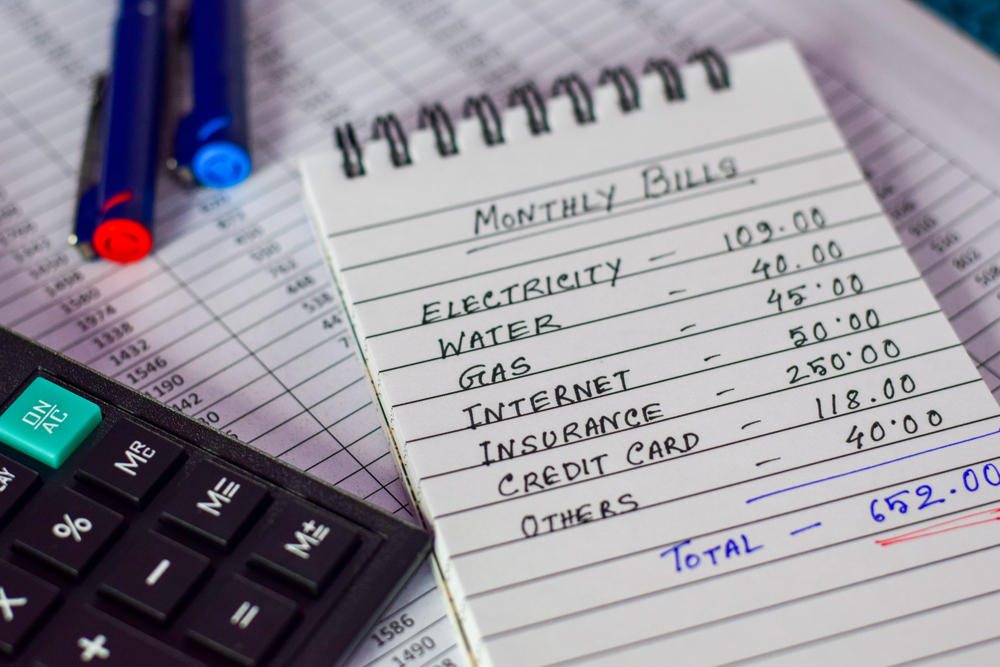

If you are struggling to keep a lid on your expenses, prioritising your spending can help you list your bills in order of importance, meet your essential costs, and, perhaps most importantly, lower your stress levels.

The most important bills are those that keep a roof over your head, such as your mortgage or rent (including arrears), utilities, council tax, and secured loans.

This is because the consequences of not paying priority bills are far greater than the consequences of not paying non-priority bills, such as credit cards, unsecured loans, and overdrafts.

Cut your monthly expenses

It can be easier said than done but by cutting your monthly expenses, you can claw back some spare cash and build a buffer to bring your budget back into the positive.

To do so, try swapping supermarket-bought lunches for homemade alternatives, shopping around for a cheaper gas and electricity provider, and ditching the daily commute for a walk or cycle.

The 21/90 rule states that it takes a minimum of 21 days to form a habit and 90 days for it to become a permanent lifestyle choice. So, by making minor changes to your monthly spending habits and repeating them for 90 days, your finances could be significantly improved within a matter of months.

Boost your income

When it comes to cutting your expenses, there is only so much you can do. But with no limit to the amount of extra cash you can earn, making an effort to boost your income can be the missing link you need to help you meet your essential costs.

If possible, ask for a raise at work, start a blog, monetise a hobby or interest, pick up a part-time job, become an online tutor, or sell unwanted clothes, with the internet a great place to find a side hustle or money-making venture to work around your schedule.

This can help you repay your debts, build your savings, or just bridge the gap between your finances and your essential costs when you find yourself struggling to make ends meet.

Make a plan

The only way to make a positive difference to your finances is to make a plan (and stick to it).

To get started, assess your current financial situation and set yourself a series of short-term goals, such as starting an emergency savings fund, sticking to a budget, or clearing a percentage of your debt.

Whether you have your sights set on becoming a homeowner, retiring early, or clearing your total debt, making a plan can help you set mini milestones and track your progress until you meet your ultimate goal.

Check if you qualify for financial support

In October, every household in the UK will receive £400 and pensioners claiming Winter Fuel Payment will receive £300 to help with the cost of rising energy bills as part of a £21 billion cost of living package.

If you are still worried about meeting your essential costs despite cutting costs and qualifying for a cost of living payment, however, it is worth checking if you are eligible for financial support.

To find out what financial support you are entitled to and how to make a claim, contact your local council or visit the GOV.UK website.

How we helped Michael

"Professional staff - they were understanding and non-judgmental. Fantastic, quick service too. Would recommend to anyone!"

Michael, Sunderland